Table of Content

The problem happens when you try to apply for a higher loan amount, and the banks do not grant it. A joint home loan can increase the chances of getting a higher home loan amount. Expect for the statements UNION Bank of India is doing good when it comes to housing loan. The process was a bit lengthy ultimately I had taken loan from Union bank of INDIA. Joint home loans are definitely an option worth considering since it has several benefits when compared to a regular home loan. If you are looking for a home loan, it is better to plan a joint home loan with your family members.

You can opt for cheque or electronic clearance/standing instruction to your bank, as per your convenience. A home is a haven, your own little paradise to share with your loved ones. Owning a home has become easier with the availability of home loans offered by various banks and financial institutions at attractive and affordable interest rates. The real problem lies in choosing the right options that will ensure that you avail a home loan that is best suited to your needs. The right home loan scheme helps to increase your savings and reduce the burden of debt.

Credit Card

Improve your credit score– Being disciplined with your finances lead to a better credit score. A good score is generally above 700, and getting a good score will improve your chances of getting a Home Loan at a low rate. HDFC Ltd. reserves the right to withdraw the offer on interest rates at any point in time, without any further intimation or notice, and no claims shall be entertained by HDFC Ltd. in this regard. Various Builder/Developer who have advertised their products.

All the applicants in the joint loan share the equal financial responsibility of repaying the loan. People can add their spouses, siblings, children, or parents as co-applicants. You cannot take a joint housing loan with any random person, or even a business partner. Only close relatives – spouse, parents, siblings or children – can be co-borrowers in a housing finance scheme. A joint home loanis a housing loan which is taken by more than one person and repaid with equal financial responsibility.

Loan for Europe Holiday Packages at lowest rates

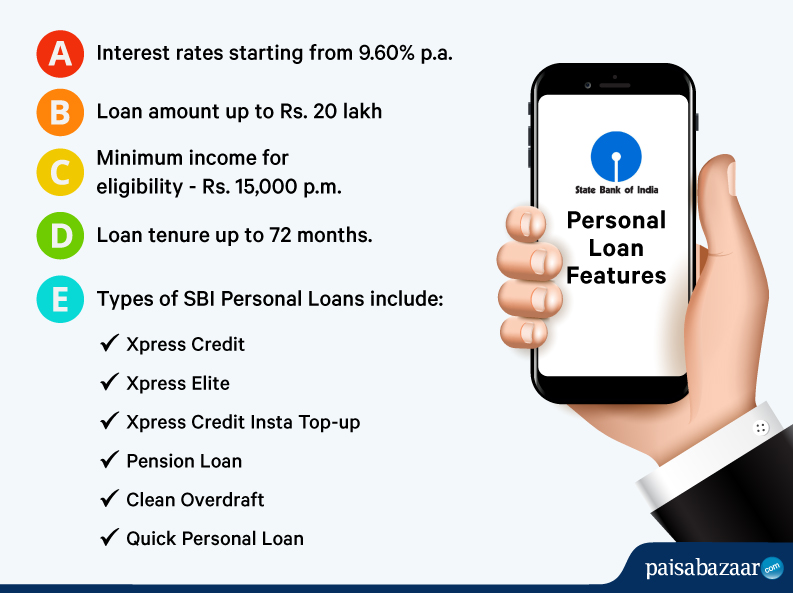

State Bank of India’s home loan eligibility depends on a number of factors such as the age of the applicant, credit score, and income or salary. The prepayment of loans is allowed by making lump sum payment before the loan tenure but some banks may apply a penalty of 2%-3% of principal payment. If the entire loan amount is paid off before the tenure, then banks and financial companies charge this fee. The pre-payment charges could be 5% of the amount that the borrower pays before the term ends.

So if you are moving in with your spouse or any other family member and wish to avail of a loan, then a joint home loan is to your rescue. It will surely turn out to be the best decision of your life as it amplifies your savings and reduces the heavy burden called debt. A top-up loan is defined as an additional loan that can be availed by the borrower only if the payments for the existing loans are made on time. A financial company would grant a joint home loan only with the immediate family members or business partners in rare cases. Tax exemptions are not valid for property under construction, even if the loan amount is used to renovate the house.

Application Forms

Reduce existing Debts–A lender will look into your Debt-to-Income ratio before approving your Home Loan application. A DTI of over 50% is likely to reduce your chances of getting a Home Loan. Therefore, make sure to pay off at least some of your current debts.

It might be in the form of a donation to the down payment or your portion of the mortgage. A co-borrower in the house loan application may also be a joint owner of a property, even if you have paid for your portion of the property in full with the down payment. Taking a joint loan with a non-working spouse will not benefit you in tax savings and loan amount. The same is the case with taking a joint loan with non-working parents. However, if you take a joint loan with your non-working wife or non-working mother, you might benefit from lower stamp duty and lower interest rates. Fully satisfied with HDFC LTD the level of service provided by them was really good.

This is my joint loan home loan and I have taken it along with my brother.The customer service provided by the Bank is not upto the mark as they are very slow in their process. The rate of interest charged is less when compared to others. IIFL housing loan process is very good, rate of interest is 9.25% which is the best. I had just taken this loan before 4 months, Processing fee charged was 35 k it was okay. They had taken around one month to provide this housing loan and it is a joint loan. PNB Housing loan is the best, PNB offered the least interest rate as compared to SBI, processing was very easy they had taken around 2 weeks for the disbursement .

State Bank of India accepts co-applicants provided they have a regular source of income or salary with documents to be furnished as proof of salary or income. This is mainly because the EMI will be less, which ensures timely repayment from your side. JLGs that undertake savings apart from credit are required to maintain books of accounts. However, the quantum of credit need not be linked to groups’ savings as in the case of SHGs. The credit requirements for the group may be worked out based on combined credit plan needs of individual members. Each member of the JLG should be provided an individual KCC / GCC or term loan.

The rate of interest charged was floating, fortunately till date there was no rise in the interest rate. I have bought home loan in HDFC Ltd since i know the people working over there, i have chosen this bank. I applied the loan amount of Rs. 62 lakhs which is a joint home loan and they have sanctioned the same. You can have a maximum of 6 applicants and a minimum of 2 applicants in a joint home loan. However, the number of co-borrowers depends on the bank’s discretion.

Borrowers are eligible for a tax deduction of up to Rs. 2 lakh per annum on interest paid on home loan, under Sec 24. It would be wiser for each applicant to take separate life insurance policies in order to cover the loan burden in case either of the borrowers dies. When you take a home loan jointly with your wife, mother, daughter or sister, and the property is owned by her either individually or jointly, some states offer a lower fee for property registration.

As a co-applicant, you can include your spouse if they are likewise employed. In addition to stamp duty exemptions, there are also interest rate reductions and tax savings on both the principal and the interest. A house loan's maximum tax advantage might be up to 7lakh per year, including principal payments and interest. Joint home loans are available only to spouses who are joint owners of the property. Certain advantages are available under the Income Tax Act of 1961 with relation to house loans. Section 24 provides home loan co-owner tax benefits for interest payments, whereas Section 80C provides tax benefits for principal repayment, subject to specific requirements.

However, if the co-borrowers jointly own a piece of land they cannot avail any tax deductions as the house would have to be constructed on that plot. Before applying for a loan one must always check the interest rates charged by each bank. Also, some banks charge various processing and other related fees when applying for a loan. If one applicant is earning and the other is unemployed, then one should not apply for a joint loan. In this case, no doubt the loan offered would be higher, but then so will be the burden to repay the same loan without any external income from the other applicant.

Tax Benefit on Joint Home Loan

• According to this section, the first time buyers can claim an additional Rs. 50,000 deduction on payable interest. Repayment of the loan could either be done through a joint account, or both the parties could distribute the EMIs among themselves and then pay off the debt. As of the 2017 budget, the amount of interest claimed as a deduction for rental property is limited to Rs 2lakh.

No comments:

Post a Comment